Sin taxes: the examples of alcohol and tobacco

Economic Note

Read the Economic Note in PDF format… | Read the Media release…

Economic Note prepared by Valentin Petkantchin, associate researcher at the Institut économique Molinari

So-called “sin” taxes are very much in fashion, especially with the public authorities coming under pressure to get the public accounts in order, in France and elsewhere. With regard to alcohol and tobacco, this relatively recent type of taxation takes over from a long history of high and specific taxes on these common consumer goods. With the aim of reducing “sinful” behaviour and financing the health care system, public authorities are planning to raise the tax load on these products even higher.

This type of policy obviously has its risks for business competitiveness. And more important, it causes consumers to act in ways that are just as dangerous to their health, if not more so. It also provides a powerful stimulus for the growth of the parallel market and of smuggling, two phenomena that are just as old as the taxes on these very products. All this suggests that the concept of sin taxes should be applied with caution.

SIN TAXES AND ALCOHOLIC DRINKS

Alcoholic drinks have long been seen as a source of extra tax revenue.(1) They brought nearly €2.8 billion into the public coffers in 2012 in the form of excise duties and related taxes alone, not counting VAT.(2) Despite this already large amount, and in a context of total alcohol sales that were already down sharply in France over the last few decades due to lower wine sales,(3) the French public authorities want to continue focusing on alcohol taxation.

In the name of behavioural taxation, and with the excuse that excise taxes may be higher elsewhere, as in the United Kingdom or the Nordic countries, taxes on beer rose by 165% in 2013. Plans to raise taxes on wine are also being discussed. This policy of raising taxes on alcohol drinks has its share of dangers.

An ineffective way to fight alcoholism

While sales of alcoholic drinks may in fact decline due to taxation,(4) penalising the entire sector along with consumers as a whole, this risks producing a series of adverse effects.

First, these taxes make no distinction between “responsible” consumers, who drink in moderate quantities, and those whose alcohol consumption is abusive. Abusive drinkers are known not to be highly sensitive to price increases,(5) and it is mostly moderate drinkers who end up reducing their consumption. As such, this phenomenon reduces the effectiveness of taxes as a tool in the fight against alcoholism.

Also, this type of policy tends to cause consumers to turn to relatively inexpensive products, that are lower in quality or higher in alcohol (or to drink at home rather than at a bar, hotel or restaurant). Taxes on alcoholic drinks may even cause consumers to turn to the use of illicit drugs, such as cannabis.(6) Again, lower alcohol sales do not necessarily produce better results in health terms.

Finally, despite the ineffectiveness of sin taxes, the drawbacks set out above may serve to make things worse. It remains politically tempting to attribute this ineffectiveness to the notion, for example, that the increases may not have been high enough or that they fail to affect all drinks in the same way.

Taxes on alcohol therefore risk spreading to all categories of alcoholic drinks, including wine, and then rising continuously and repeatedly. Once embarked on this path, alcohol taxes in France are likely to move gradually closer to those in the United Kingdom and the Nordic countries.

Spurring the parallel market

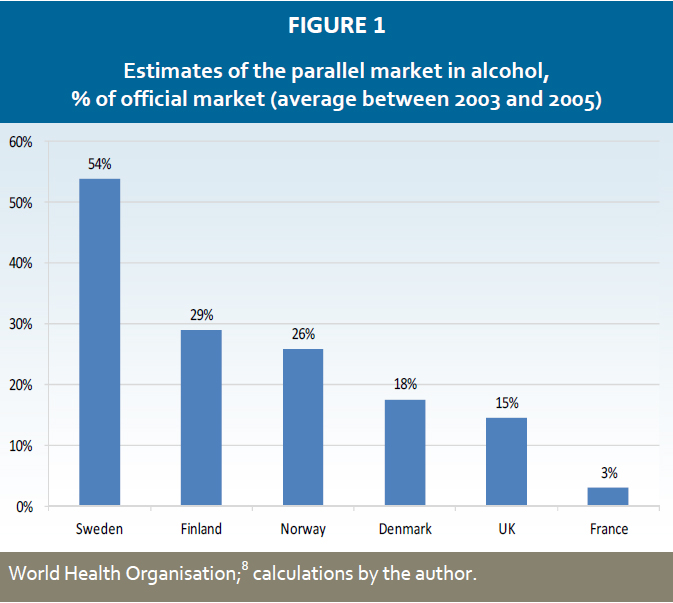

Causes and effects are related: France could give itself a dynamic parallel market in alcohol. The risk of this market taking off should not be underestimated. According to World Health Organisation figures, this risk has turned to reality in high-tax countries. It may account for 15% of the market in the United Kingdom and up to 54% in Sweden (see Figure 1).

Causes and effects are related: France could give itself a dynamic parallel market in alcohol. The risk of this market taking off should not be underestimated. According to World Health Organisation figures, this risk has turned to reality in high-tax countries. It may account for 15% of the market in the United Kingdom and up to 54% in Sweden (see Figure 1).

To little surprise, and as noted by the European Commission in 2004, it is only in the latter country that public health goals play a dominant role in the setting of excise rates.(7)

Seeking to use taxes for health purposes thus expose entire populations to a parallel market in alcohol, with its share of crime, violence and risks to consumers’ health.

Beyond the loss of tax revenues, estimated in the United Kingdom, for example, at £1 billion per year, the presence of this market is also a real source of health risks. For instance, large-scale trafficking of vodka made from industrial alcohol, containing methanol and used in coolants, was discovered in the U.K. in 2013.(9)

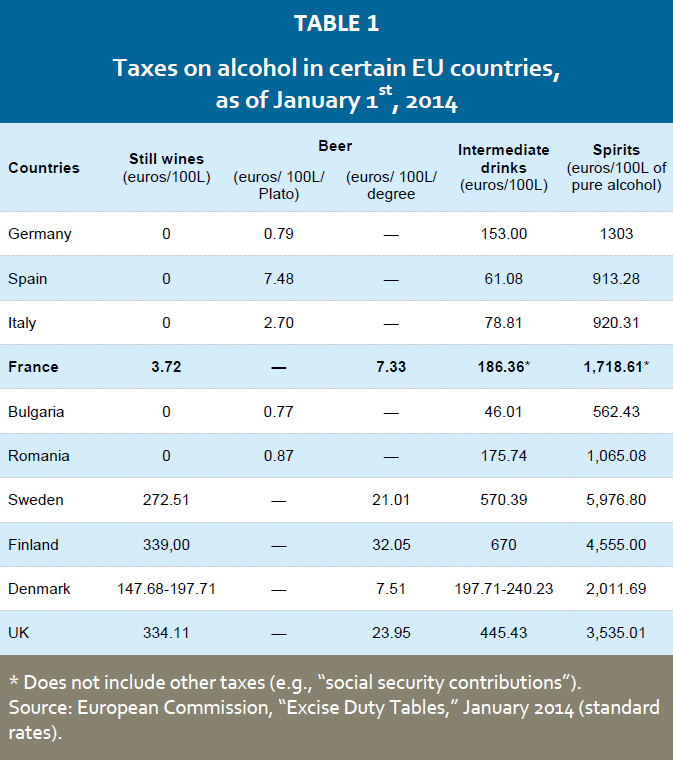

For the moment, France seems largely to have escaped the parallel market phenomenon, with taxes still low compared to other countries. The situation could change quickly, however, especially since Spain and Italy have no excise duties on wine and certain Eastern European countries, such as Bulgaria and Romania, have alcohol taxes lower than those in France (see Table 1).

For the moment, France seems largely to have escaped the parallel market phenomenon, with taxes still low compared to other countries. The situation could change quickly, however, especially since Spain and Italy have no excise duties on wine and certain Eastern European countries, such as Bulgaria and Romania, have alcohol taxes lower than those in France (see Table 1).

SIN TAXES AND TOBACCO

Tobacco is another product widely consumed in Europe for centuries. It is also a product, like tobacco, that has long been subjected to high taxes. These taxes are often portrayed as the key reason for lower tobacco consumption since the 1980s.(10)

However, this link between higher taxes and lower tobacco consumption is not automatic. A number of indices show that repeated increases and the use of tax constraints create many adverse effects that are underestimated or simply left out of public debate.

This point is all the more important given that smoking seems to have ceased declining — in France and in other European countries — since the mid-2000s.(11) Before going into a new wave of increases in taxes and tobacco prices, it would be wise to consider the full range of effects this type of policy could produce.

Tobacco taxes and risks to smokers’ health

First, high taxes and the increased prices they cause may lead to unexpected behaviour by smokers. This type of policy causes smokers to turn to cheaper but more powerful cigarettes. Even if they smoke fewer cigarettes, they tend to smoke each one more intensely, thereby increasing the amount of tar and nicotine ingested per cigarette smoked,(12) a result contrary to the aim of sin taxes.

Higher taxes also cause smokers to turn to other products that cost less than standard manufactured cigarettes, such as rolling tobacco, the consumption of which has risen in many countries.

In France, official sales of rolling tobacco went from 5,600 tonnes in 2001 to 8,500 tonnes in 2012, a 52% increase.(13) In the United Kingdom, 39% of male smokers and 23% of female smokers consume rolling tobacco (2010 figures), compared to just 18% and 2% respectively in 1990.(14) According to a survey in Belgium, while 25% of smokers questioned said they had consumed rolling tobacco between 2008 and 2012, this figure jumped to 35% in 2013,(15) when sales beat all records, soaring to more than 10,110 tonnes, up 22% in just one year.(16)

However, the consumption of rolling tobacco is just as harmful to smokers’ health, if not more so. It is true that the severity of these health risks depends on each individual case (whether filters are used, the quantity of tobacco rolled, and so on). But a study conducted in the United Kingdom on smokers of rolling tobacco found that the mean tar yields from cigarettes rolled by 57% of them were actually greater than the maximum contained in a manufactured cigarette and that 77% of these smokers produced cigarettes with more nicotine.(17) In New Zealand, an anti-tobacco group notes that “roll-your-own cigarettes (…) have on average more nicotine, tar and carbon monoxide than manufactured cigarettes, a higher tar/nicotine ratio (…)”.(18)

A number of other studies show that rolling tobacco may also be associated with a higher risk of cancers such as cancer of the oesophagus, mouth, pharynx or larynx.(19) As one specialist notes, “[t]he most common reason (over 80% in most studies) given for smoking RYO [roll-your-own] cigarettes is that they are cheaper.”(20) Contrary to their stated goals, sin taxes paradoxically push smokers toward these products that cost less but tend also to be riskier to the health.

But might it not suffice to align taxes on rolling tobacco with those on cigarettes and then keep raising taxes on all tobacco products to deal with these unexpected adverse effects?

Tobacco taxes and the parallel market: a headlong rush

The answer is that this is not a long-lasting solution. It would simply amount to a headlong rush that would add its own share of adverse effects.

What must not be lost from sight is that, unless consumers decide on their own to stop smoking, any increase in taxes will cause them to turn to substitutes.

If every product sold on the official market, without exception (including rolling tobacco) is overtaxed, smokers will be certain to turn to the parallel market, with cross-border purchases, counterfeits or contraband. A Canadian study found that “contraband cigarettes are perceived to be a near-perfect substitute for lawfully purchased cigarettes.”(21)

Causing people who still buy rolling tobacco on the lawful market to turn instead to the illicit market will nurture contraband. This presents numerous drawbacks for the lawful tobacco sector and for smokers, without bringing any health benefits.

This shift is made more likely by the fact that the parallel market is well established. As regards consumption of illicit tobacco, the European Commission talks about a 30% increase between 2007 and 2012,(22) noting that “some significant seizures of hand rolling tobacco” have been recorded. Illicit trafficking of rolling tobacco will therefore not fail to fill the gap if the official market is handicapped by substantial tax increases.

In France, the phenomenon of a parallel market in tobacco seems to have grown significantly following the tax increases of 2003-2004. Estimates indicate that it may now stand at about 20% to 23%,(23) or one cigarette in five. Given that, by definition, this lies outside the control of the public authorities, it is impossible to get a precise idea of how it is evolving. But one thing is certain: the ubiquity of the parallel market, as with alcohol in some high-tax countries, makes any estimate of actual tobacco consumption less reliable.

The “radicalisation” of the parallel market

It should also be understood that, with repeated hikes in tobacco taxes, the parallel market could turn more radical, with illicit trafficking taking the lead in France over lawful cross-border purchases.

The contraband market adapts ceaselessly to avoid repressive measures by the public authorities. The European Commission notes, for example, that despite European efforts to fight contraband, the EU “faces a rising illicit influx of other brands coming from outside the EU as well as increased illicit production and distribution inside the EU.”(24)

With controls focusing on the traditional tobacco supply chain, contraband dealers have turned to these “other brands,” also called “illicit whites” or “cheap whites.”

These are authentic Chinese, Russian, Ukrainian or other cigarette brands that are produced legally in a third country but intended largely for contraband in high-tax countries.

The gap in cigarette taxes and prices is substantial between these third countries — notably at the EU’s eastern boundary — and EU countries. It should also be noted that in France, since January 1, 2014, this price is among the highest in Europe, making the parallel market even more profitable with the quotas on cigarettes that an individual can bring from another EU country also having risen.(25) Any proposal aimed at a sharp boost in taxes (for instance, 10% or more) will only aggravate the situation.

The gap in cigarette taxes and prices is substantial between these third countries — notably at the EU’s eastern boundary — and EU countries. It should also be noted that in France, since January 1, 2014, this price is among the highest in Europe, making the parallel market even more profitable with the quotas on cigarettes that an individual can bring from another EU country also having risen.(25) Any proposal aimed at a sharp boost in taxes (for instance, 10% or more) will only aggravate the situation.

The smuggling of cheap “white” products seems to be rising considerably as a share of customs seizures the last few years. According to the World Customs Organization, their number and the quantity seized rose by 52% and 17% respectively between 2011 and 2012.(26)

Traffickers no longer hesitate to invest in actual infrastructure for their contraband activities. In 2012, the Slovakian authorities “discovered a 700-metre tunnel, equipped with its own train to smuggle goods and possible people.”(27) Linking Ukraine and Slovakia, it was “built with professional mining technology” and amounted “to an estimated tax evasion of €50 million per year.”

The other threat of radicalisation occurs within the EU and takes the form of illegal factories, with tobacco that may contain “unacceptable levels of nicotine, tar, carbon monoxide, arsenic and cadmium.”(28) In this regard, the European Commission notes a sharp rise in the number of illegal factories discovered, going from five in 2010 to nine in 2011, with production capacity estimated at more than nine million cigarettes per day.(29)

All this evidence indicates that tobacco taxes are nurturing a highly dynamic parallel sector. Any new increase risks resulting in more adverse effects and a bigger parallel market. The future increases being considered in France could therefore result in a simple transfer of consumption from purchases on the legal market (meaning a decline in official sales) to the parallel market, whether legal or illegal, with no drop in actual consumption and with government revenues stagnating or even falling.

CONCLUSION

Alcohol and tobacco have long been overtaxed. In both cases, new tax increases have been instituted or are being considered in the name of behavioural “sin” taxation. This policy of tax increases penalises legal sectors as well as consumers. Drinkers and smokers alike are pushed toward similar products that are at least as hazardous to the health, reducing or eliminating the hoped-for health benefits.

The cases of alcohol and tobacco show perfectly that, beyond a certain point, the legal market and the parallel market operate like “connecting vessels.” The example they provide illustrates the limits of exploiting the tax system to meet health goals.

The adverse effects of this abuse of the tax system remain broadly underestimated and sometimes are quite simply ignored. They need to be put at the centre of public debate at a time when sin tax plans are proliferating.

NOTES

1. Taxes on drinks containing alcohol were among the very first excise duties in England (in the mid-18th century) and in the United States (in 1791, with the whiskey tax and the famous Whiskey Rebellion).

2. See the European Commission, « Excise Duty Tables (Tax receipts: alcoholic beverages), » July 2013, at:

http://ec.europa.eu/taxation_customs/resources/documents/taxation/excise_duties/alcoholic_beverages/rates/excise_duties_alcohol_en.pdf.

3. See the data from the Office français des drogues et des toxicomanies on sales of alcohol, available at (page visited in March 2014): http://www.ofdt.fr/BDD_len/seristat/00014.xhtml. Sales (as measured in litres of pure

alcohol) have thus fallen by more than half since the 1960s; the decline between 2000 and 2012 was 15.7%.

4. Looking at beer, for example, the market was already down 3% at the end of September 2013, with sales at cafés, hotels and restaurants recording an 8% decline. See « La consommation de bière en baisse » (Beer consumption falling), Le Point, December 13, 2013, available at: http://www.lepoint.fr/economie/la-consommation-de-biere-en-baisse-13-12-2013-1768772_28.php.

5. See Manning et al., « The demand for alcohol: the differential response to price, » Journal of Health Economics, 14(2), June 1995, pp. 123-148.

6. See, for example, Benjamin Crost and Santiago Guerrero, « The effect of alcohol availability on marijuana use: evidence from the minimum legal drinking age, » Journal of Health Economics, Vol. 31/1, January 2012, pp. 12-121, as well as the references cited there in this regard.

7. See the Report from the Commission to the Council, the European Parliament and the Economic and Social Committee, of 26 May 2004, on the rates of excise duty applied on alcohol and alcoholic beverages, COM/2004/0223, available at: http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:52004DC0223:EN:HTML.

8. See the various data by countries, « Country profiles 2011, » available at: http://www.who.int/substance_abuse/publications/global_alcohol_report/profiles/en/. The parallel market corresponds to unrecorded per-capita consumption of pure alcohol by people 15 and older; the official market corresponds to recorded per-capita consumption among the same group. While official consumption in Sweden was only 6.7 litres (compared to 13.3 litres in France), parallel market consumption may be 3.6 litres, or nearly 9 times as high in absolute terms as in France (0.4 litre).

9. See HM Revenue & Customs and HM Treasury, « Tackling alcohol fraud, » consulted in March 2014 at:

https://www.gov.uk/government/policies/reducing-tax-evasion-and-avoidance/supporting-pages/tackling-alcohol-fraud.

10. According to empirical studies, the ratio between the change in sales and the change in price, known as the price elasticity ratio, may by most estimates be around 0.4, meaning that a 10% rise in taxes could be expected to produce a decline of about 4% in tobacco consumption. See, for example, the « WHO Technical Manual on Tobacco Tax Administration, » WHO, 2013, p. 21, available at:

http://whqlibdoc.who.int/publications/2010/9789241563994_eng.pdf?ua=1.

11. See Marien Ng et al. « Smoking prevalence and cigarette consumption in 187 countries, 1980-2012, » The Journal of the American Medical Association, January 2014 311(2), pp. 183-192.

12. See Valentin Petkantchin, 2014, « The pitfalls of so-called ‘sin’ taxation, » Institut économique Molinari, January 2014, pp. 3-4, available at: http://molinari.nvt.one/the-pitfalls-of-so-called-sin,1778.html and the references cited there.

13. See also Catherine Hill, « Impact de l’augmentation des prix sur la consommation de tabac » (Impact of higher prices on tobacco consumption), Institut Gustave Roussy, 2013, p. 11. It covers continental France.

_14. See Charlie Cooper, « Rollies vs Straight: Roll-your-own ‘at least as hazardous as any other type of cigarette’, » The Independent, February 12, 2014, available at:

http://www.independent.co.uk/life-style/health-and-families/health-news/rollies-vs-straights-rollyourown-at-least-as-hazardous-as-any-other-type-of-cigarette-9122464.html.

15. See the news release from the Fondation contre le cancer, « Avec la crise, les fumeurs se tournent vers le tabac à rouler » (With the crisis, smokers are turning to rolling tobacco), June 26, 2013, available at:

http://www.cancer.be/avec-la-crise-les-fumeurs-se-tournent-vers-le-tabac-%C3%A0-rouler.

16. See « Record de vente de tabac à rouler en Belgique » (Record rolling tobacco sales in Belgium), Le Soir, January 24, 2014, available at:

http://www.lesoir.be/410400/article/actualite/belgique/2014-01-24/record-vente-tabac-rouler-en-belgique.

17. See Keith Darall and John Figgins, “Roll-your-own smoke yields: theoretical and practical aspects,” Tobacco Control 1998;7, pp. 168-175.

18. See Smoke free New Zealand, « Roll-your-own cigarettes are not safer to smoke than tailor-made cigarettes, » February 2009, available at: http://smokefree.org.nz/sites/default/files/Fact_Rollies-fnl-081003.pdf. Various references cited there show that health hazards are actually greater with the consumption of rolling tobacco than with manufactured cigarettes.

19. See for example Murray Laugesen et al. « Hand-rolled cigarette smoking patterns compared with factory-made cigarette smoking in New Zealand men, » BMC Public Health, June 2009, available at:

http://www.biomedcentral.com/1471-2458/9/194.

20. See Richard Edwards, « Roll your own cigarette are less natural and at least as harmful as factory rolled tobacco, » British Medical Journal; 348, February 2014.

21. See Nachum Gabler and Diane Katz, « Contraband tobacco in Canada, » Fraser Institute, July 2010, p. 38, available at:

http://www.fraserinstitute.org/uploadedFiles/fraser-ca/Content/research-news/research/publications/contraband-tobacco-in-canada(1).Pdf.

22. See the Communication from the Commission to the Council and the European Parliament, titled « Stepping up the fight against cigarette smuggling and other forms of illicit trade in tobacco products — A comprehensive EU strategy, » COM(2013) 324 Final, June 6, 2013, p. 7, available at: http://ec.europa.eu/anti_fraud/documents/2013-cigarette-communication/communication_en.pdf.

23. According to Aurélie Lermenie, « Tabagisme et arrêt du tabac en 2013 » (Smoking and smoking cessation in 2013), Observatoire français des drogues et de toxicomanies, 2013, p. 4, available at:

http://www.ofdt.fr/ofdt/fr/tt_13bil.pdf, 23% of smokers questioned stated in 2013 that they had made their latest purchase outside the official network. Also, according to a 2011 Customs estimate, it may account for 20% — see Valentin Petkantchin, « What if tobacco were simply prohibited?, » Institut économique Molinari, January 2012, p. 3, available at: http://molinari.nvt.one/IMG/pdf/note0112_fr.pdf.

24. See the Communication from the Commission, 2013, op. cit., p. 5.

25. Quotas went from five cartons of cigarettes and 50 cigars per vehicle to 10 cartons and 1,000 cigars per person, in other words a quota of up to 50 cartons (10 times more) and 5,000 cigars (100 times more) for a car with five people.

26. World Customs Organization (WCO), « Illicit Trade Report 2012, » June 2013, p. 25, available at: http://www.wcoomd.org/en/media/newsroom/2013/june/wco-publishes-its-first-illicit-trade-report.aspx.

27. See WCO, 2013, op. cit., p. 16.

28. WCO, 2013, op. cit., p. 17.

29. See European Commission, 2013, op. cit., p. 9.